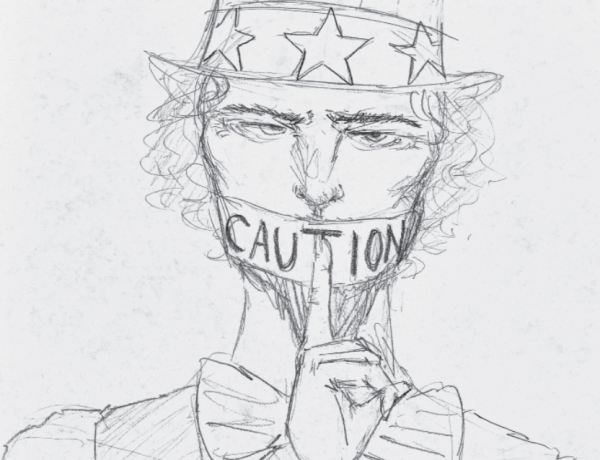

Modern-day tax scheme disguised by voting ballots

America was founded on the basis of fair representation in government. However, the American colonists were paying taxes to Britain while simultaneously being refused a voice in political decision making. “No taxation without representation” became the colonists’ battle cry and the primary motivation for the American Revolution.

With that in mind, and without ruffling any patriotic bonnets, why do working individuals under the age of 18 pay taxes if they aren’t authorized to vote? It seems hypocritical to form an independent nation on a specific formula, only to fall back on its moral ideals and tax the unrepresented population. Specifically, it doesn’t make sense for underage U.S. citizens to pay for infrastructure bills or security funding when their input on all matters are insignificant until they turn 18.

Being a high school student with a job is difficult enough without having a chunk of income taken out of the already minuscule paychecks that we receive. Considering most students are under-qualified for any high ranking positions, the majority are likely being paid minimum wage. While a 10 to 20 percent tax extraction on a $10 hourly wage is discouraging at any age bracket, the underage working population receives zero compensation for the taxes they are paying.

“It’s [taxing minors] really something to consider because minors don’t know what they’re doing, especially when it comes to taxes since they don’t teach it in the school system,” senior Rachel Bisnett said.

Like our passionate Founding Fathers, my argument isn’t against paying taxes. I find the situation problematic due to the lack of representation and voice in the political and executive sphere; except, rather than fighting an overseas monarchy, unjust policies are executed in our own country. Not to mention the racist and sexist voting policies against all who were not white male landowners at the start of the country’s creation.

However, there is a plus side amidst the taxing debacle. Some of the taxes that we pay go towards later retirement in life and it will ultimately benefit everyone in the future. The taxes go towards 401K (retirement plans) and Social Security, as well as Medicare. So while the tax reductions aren’t exactly justified in regards to representation, some of the money should circle back to advantage the underage working class in the future (assuming these policies will still be active in X amount of years).

Additionally, I’m not arguing to lower the voting age, but rather advocating to eliminate mandatory tax payment for underage workers. If there is a politician in office whose policies don’t line up with your own beliefs, but you are paying taxes for the implementation of these policies, then democracy has failed you.

“You have to be 18 to vote but once you turn 16, you reach the legal working age and therefore must pay taxes if you do get a job,” Advanced Placement Macroeconomics teacher Jessika Lozada said. “These kids [workers under 18] don’t have a say in the tax laws that ultimately end up affecting them.”

For those who are worried about the impact of losing the tax contribution from the underage workforce, individuals between the ages of 16 and 19 make up approximately 3 percent of the labor force as of 2017, according to the U.S. Bureau of Labor Statistics. This means that less than 3 percent of workers are minors, hardly denting the national income tax figure.

The sole core of the “no taxation without representation” ideology is indubitably violated. At the risk of sounding dramatic, the foundation on which the country was built is becoming progressively unstable as the future population falls victim to this ingenious scam, generation after generation. Give us a fighting chance to earn money and start saving up before we get shoved into the harsh realities of mortgages, rent, and debt payments for the entirety of our money-driven lives.